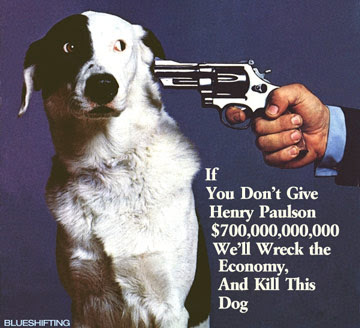

picture via Digby

Update: It's not a matter of the complexity of the "financial instruments" that a "computer tells you" are real. It's a matter of biased assumptions and dummy variables; see How Wall Street Lied to Its Computers at NYTimes.com. The finance guys weren't interested in resilient systems. The players already knew that these "instruments" were Ponzi schemes or something similar and that they couldn't always controls the herds.

Of course investors don't understand, because the game requires they don't! Now that The Fed and its allies want the marks to cover the losses, we should really question where "the money has just disappeared" to.

Of course investors don't understand, because the game requires they don't! Now that The Fed and its allies want the marks to cover the losses, we should really question where "the money has just disappeared" to.

The actual wealth is still around; it was just skimmed off quick to protect it. After all, in Pottersville we serve hard drinks for men who want to get drunk fast.

Of course investors don't understand, because the game requires they don't! Now that The Fed and its allies want the marks to cover the losses, we should really question where "the money has just disappeared" to.

Of course investors don't understand, because the game requires they don't! Now that The Fed and its allies want the marks to cover the losses, we should really question where "the money has just disappeared" to.The actual wealth is still around; it was just skimmed off quick to protect it. After all, in Pottersville we serve hard drinks for men who want to get drunk fast.

No comments:

Post a Comment